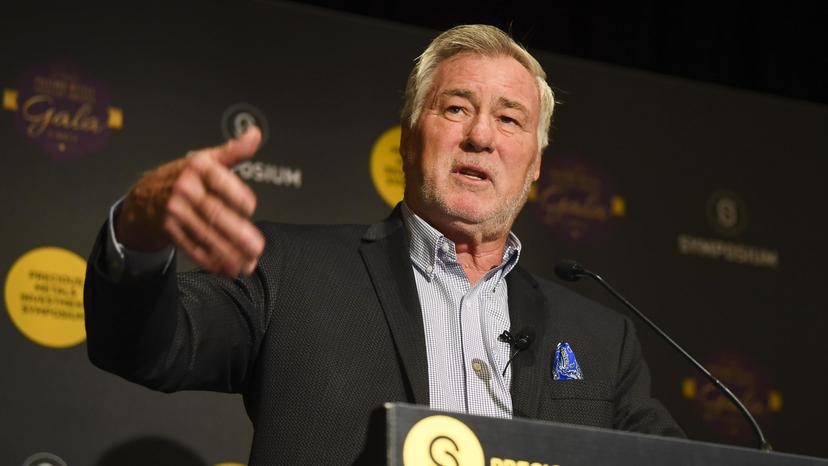

Eric Sprott is a Canadian billionaire and founder of Sprott Inc., a company that specializes in investing in pre壯陽藥 cious metals and mining companies. He has invested huge amounts of money in gold and silver, as well as in gold mining and exploration companies. In this post, we will explore how he turned gold into billions and what his outlook for the precious metal is.

Sprott started investing in gold and silver in the 1980s, when he was a fund manager at Royal Bank of Canada. He saw the potential of gold as a hedge against inflation and currency devaluation. He launched his own firm, Sprott Asset Management, in 2001, and became one of the most successful and influential gold investors in the world. He has been called “the Warren Buffett of gold” by some media outlets.

Sprott has made 31 investments in gold-related companies since 2019, according to Crunchbase. His latest investment was in Lavras Gold, a Brazilian gold exploration company, in September 2023. He has also invested in physical gold bullion, and owns one of the largest private gold reserves in the world. He believes that gold is undervalued and will reach $5,000 per ounce in the next few years.

Sprott has achieved impressive returns on his gold investments over the years. For example, in 2010, his flagship fund, Sprott Gold and Precious Minerals Fund, returned 69%, outperforming the S&P 500 Index by 63%. In 2020, his fund returned 48%, beating the S&P 500 Index by 32%.

Sprott is bullish on gold and expects it to continue to rise in the future. He cites several factors that support his view, such as the global debt crisis, the monetary and fiscal stimulus, the negative real interest rates, the geopolitical tensions, the supply and demand imbalance, and the increasing investment demand.

Sprott is not only a savvy investor, but also a generous philanthropist. He has donated millions of dollars to various causes, such as health, education, arts, and environment. He has also supported the development of the mining industry and the communities where it operates.

Eric Sprott is a gold legend and a role model for many investors. He has shown how to turn gold into billions and how to make a positive impact on the world. He is a true golden boy.

Here’s a brief overview of his journey:

Early Interest in Gold: Eric Sprott’s interest in gold was evident even before the 2008 financial crash1. He advised investors to buy gold, a decision that proved prescient when gold rallied to a new all-time high of over $2000/oz following the financial crisis1.

Investments and Acquisitions: Sprott’s strategic investments and acquisitions played a significant role in his success. He obtained a stake in Kirkland Lake Gold and became its Chairman2. He oversaw its merger with Crocodile Gold, a move that led to the success of Fosterville Gold Mine2. In 2022, he invested $125.9 million in New Found Gold Corp, an early-stage exploration company in Newfoundland and Labrador2.

Sprott Money Ltd.: Sprott Money Ltd., specializing in the sale of bullion, bullion storage, and precious metals registered investments, is another testament to Sprott’s dedication to the gold industry3. The company, headed by Eric Sprott and President Larisa Sprott, is considered one of the most well-known and reputable precious metal firms in North America3.

Galleon Gold: Eric Sprott also became the controlling shareholder of Galleon Gold4, a North American exploration and development company focused on advancing two projects: The Neal Gold Project in Idaho and the West Cache Gold Project in Ontario4.

Insights and Predictions: Sprott continues to share his insights and predictions about the gold market. He regularly discusses topics like inflation, naked shorting, interest rates, and the precious metals market35. His analyses not only dissect today’s financial landscape but also offer a preview of what’s in store for the future35.

Through his passion for gold, strategic investments, and insightful market analyses, Eric Sprott has indeed turned his love for gold into a multi-billion dollar empire.

Investing in gold can be a strategic move for a variety of reasons. Here are some key points to consider:

- Hedge Against Inflation: Gold has historically been an excellent hedge against inflation. When inflation rises, the value of currency goes down, but gold prices tend to rise. This is because gold is seen as a good store of value, so people may be encouraged to buy gold when they believe that their local currency is losing value.

- Diversification: Gold is a great way to diversify a portfolio because it is not positively correlated with other assets. This means that even if other investments are performing poorly, gold may still hold or even increase its value.

- Long-Term Store of Value: Gold has maintained its value throughout history, making it a long-term store of value. It’s the metal we fall back on when other forms of currency don’t work, which means it always has some value as insurance against tough times.

- Protection Against Currency Fluctuations: When the value of the U.S. dollar falls against other currencies, people often flock to the security of gold, which raises gold prices. This makes gold a valuable asset in times of currency instability.

- Tangible Asset: Gold is a tangible asset that you can hold in your hand, and it does not require any paper contract or middleman to make it whole. This means gold won’t go to zero. It’s never happened in its 3,000+ year history.

- Global Store of Value: As a global store of value, gold can also provide financial cover during geopolitical and macroeconomic uncertainty.